Coupon Rate Equals Yield To Maturity . the yield to maturity (ytm) is an estimated rate of return. the coupon rate is the annual interest earned while yield to maturity reflects the total rate of return produced by the bond when all interest. a bond's yield to maturity (ytm) is the percentage rate of return for a bond, assuming that the investor holds the. coupon rate refers to the annual interest payment made by the bond issuer relative to its face value, while ytm. a bond's yield to maturity is the internal rate of return required for the present value of all future cash flows, including. If you plan on buying a new. It assumes that the bond buyer will hold it until its. yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price).

from www.slideserve.com

yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). a bond's yield to maturity is the internal rate of return required for the present value of all future cash flows, including. a bond's yield to maturity (ytm) is the percentage rate of return for a bond, assuming that the investor holds the. If you plan on buying a new. the coupon rate is the annual interest earned while yield to maturity reflects the total rate of return produced by the bond when all interest. coupon rate refers to the annual interest payment made by the bond issuer relative to its face value, while ytm. It assumes that the bond buyer will hold it until its. the yield to maturity (ytm) is an estimated rate of return.

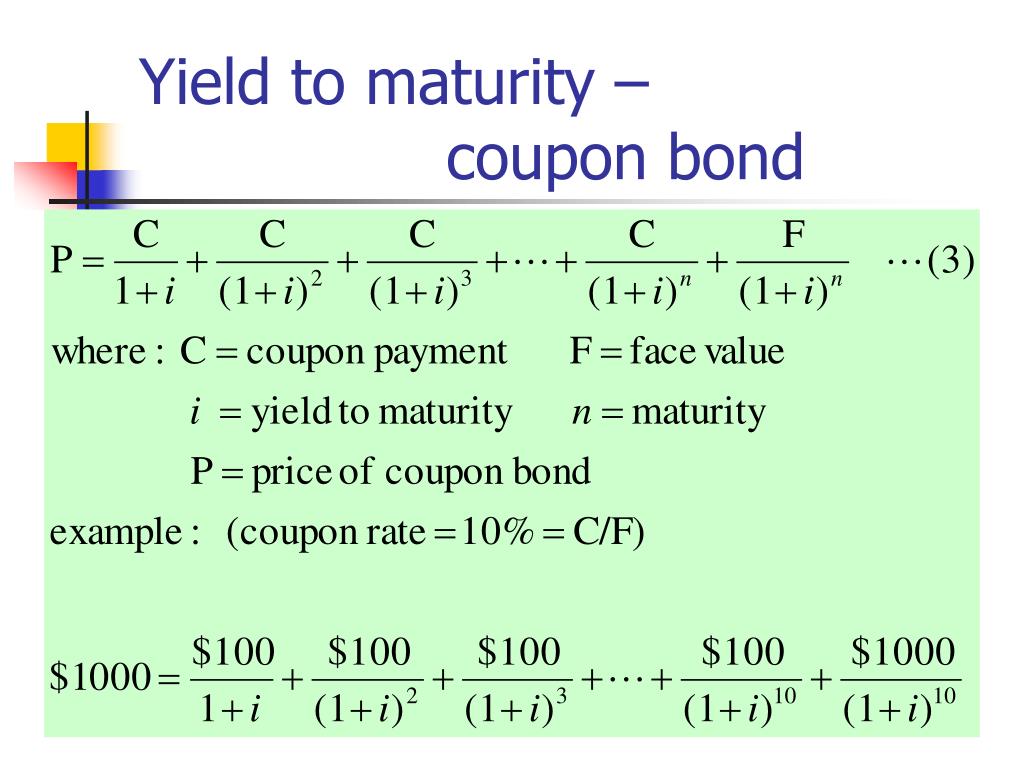

PPT The Economics of Money, Banking, and Financial Markets Mishkin

Coupon Rate Equals Yield To Maturity yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). a bond's yield to maturity (ytm) is the percentage rate of return for a bond, assuming that the investor holds the. It assumes that the bond buyer will hold it until its. a bond's yield to maturity is the internal rate of return required for the present value of all future cash flows, including. the coupon rate is the annual interest earned while yield to maturity reflects the total rate of return produced by the bond when all interest. coupon rate refers to the annual interest payment made by the bond issuer relative to its face value, while ytm. yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). the yield to maturity (ytm) is an estimated rate of return. If you plan on buying a new.

From analystprep.com

Bond’s Maturity, Coupon, and Yield Level CFA Level 1 AnalystPrep Coupon Rate Equals Yield To Maturity a bond's yield to maturity is the internal rate of return required for the present value of all future cash flows, including. a bond's yield to maturity (ytm) is the percentage rate of return for a bond, assuming that the investor holds the. yield to maturity will be equal to coupon rate if an investor purchases the. Coupon Rate Equals Yield To Maturity.

From www.youtube.com

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) Explained Coupon Rate Equals Yield To Maturity a bond's yield to maturity is the internal rate of return required for the present value of all future cash flows, including. yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). the coupon rate is the annual interest earned while yield to maturity reflects the. Coupon Rate Equals Yield To Maturity.

From www.youtube.com

MBA FIN08 3 Bond Estimating coupon rate, current yield and yield to Coupon Rate Equals Yield To Maturity the yield to maturity (ytm) is an estimated rate of return. the coupon rate is the annual interest earned while yield to maturity reflects the total rate of return produced by the bond when all interest. yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price).. Coupon Rate Equals Yield To Maturity.

From www.slideserve.com

PPT Bond Prices and Yields PowerPoint Presentation, free download Coupon Rate Equals Yield To Maturity It assumes that the bond buyer will hold it until its. a bond's yield to maturity is the internal rate of return required for the present value of all future cash flows, including. the yield to maturity (ytm) is an estimated rate of return. the coupon rate is the annual interest earned while yield to maturity reflects. Coupon Rate Equals Yield To Maturity.

From www.educba.com

Coupon vs Yield Top 8 Useful Differences (with Infographics) Coupon Rate Equals Yield To Maturity yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). a bond's yield to maturity (ytm) is the percentage rate of return for a bond, assuming that the investor holds the. coupon rate refers to the annual interest payment made by the bond issuer relative to. Coupon Rate Equals Yield To Maturity.

From www.chegg.com

Solved The annual coupon rate of a bond equals A) its Coupon Rate Equals Yield To Maturity the coupon rate is the annual interest earned while yield to maturity reflects the total rate of return produced by the bond when all interest. the yield to maturity (ytm) is an estimated rate of return. It assumes that the bond buyer will hold it until its. a bond's yield to maturity is the internal rate of. Coupon Rate Equals Yield To Maturity.

From www.investopedia.com

Current Yield vs. Yield to Maturity Coupon Rate Equals Yield To Maturity a bond's yield to maturity is the internal rate of return required for the present value of all future cash flows, including. It assumes that the bond buyer will hold it until its. yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). the yield to. Coupon Rate Equals Yield To Maturity.

From www.chegg.com

Solved When the yield to maturity is equal to, greater than Coupon Rate Equals Yield To Maturity yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). a bond's yield to maturity is the internal rate of return required for the present value of all future cash flows, including. If you plan on buying a new. the yield to maturity (ytm) is an. Coupon Rate Equals Yield To Maturity.

From slideplayer.com

Chapter 4 The Meaning of Interest Rates ppt download Coupon Rate Equals Yield To Maturity coupon rate refers to the annual interest payment made by the bond issuer relative to its face value, while ytm. yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). a bond's yield to maturity is the internal rate of return required for the present value. Coupon Rate Equals Yield To Maturity.

From www.slideserve.com

PPT Bond Prices and Yields PowerPoint Presentation ID3384472 Coupon Rate Equals Yield To Maturity yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). the coupon rate is the annual interest earned while yield to maturity reflects the total rate of return produced by the bond when all interest. coupon rate refers to the annual interest payment made by the. Coupon Rate Equals Yield To Maturity.

From slideplayer.com

UNDERSTANDING INTEREST RATES ppt download Coupon Rate Equals Yield To Maturity If you plan on buying a new. yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). a bond's yield to maturity is the internal rate of return required for the present value of all future cash flows, including. the yield to maturity (ytm) is an. Coupon Rate Equals Yield To Maturity.

From slideplayer.com

Understanding Interest Rates ppt download Coupon Rate Equals Yield To Maturity coupon rate refers to the annual interest payment made by the bond issuer relative to its face value, while ytm. the yield to maturity (ytm) is an estimated rate of return. yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). a bond's yield to. Coupon Rate Equals Yield To Maturity.

From id.hutomosungkar.com

11+ How To Calculate The Yield To Maturity Trending Hutomo Coupon Rate Equals Yield To Maturity a bond's yield to maturity is the internal rate of return required for the present value of all future cash flows, including. If you plan on buying a new. a bond's yield to maturity (ytm) is the percentage rate of return for a bond, assuming that the investor holds the. the coupon rate is the annual interest. Coupon Rate Equals Yield To Maturity.

From www.youtube.com

How to Calculate The Yield To Maturity of A Zero Coupon Bond YouTube Coupon Rate Equals Yield To Maturity a bond's yield to maturity is the internal rate of return required for the present value of all future cash flows, including. a bond's yield to maturity (ytm) is the percentage rate of return for a bond, assuming that the investor holds the. coupon rate refers to the annual interest payment made by the bond issuer relative. Coupon Rate Equals Yield To Maturity.

From www.slideserve.com

PPT Chapter 6 PowerPoint Presentation, free download ID2982323 Coupon Rate Equals Yield To Maturity the yield to maturity (ytm) is an estimated rate of return. If you plan on buying a new. a bond's yield to maturity (ytm) is the percentage rate of return for a bond, assuming that the investor holds the. a bond's yield to maturity is the internal rate of return required for the present value of all. Coupon Rate Equals Yield To Maturity.

From efinancemanagement.com

Coupon Rate Meaning, Example, Types Yield to Maturity Comparision Coupon Rate Equals Yield To Maturity yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new. a bond's yield to maturity (ytm) is the percentage rate of return for a bond, assuming that the investor holds the. a bond's yield to maturity is the internal. Coupon Rate Equals Yield To Maturity.

From www.slideteam.net

Yield Maturity Vs Coupon Rate Ppt Powerpoint Presentation Layouts Coupon Rate Equals Yield To Maturity If you plan on buying a new. It assumes that the bond buyer will hold it until its. coupon rate refers to the annual interest payment made by the bond issuer relative to its face value, while ytm. a bond's yield to maturity is the internal rate of return required for the present value of all future cash. Coupon Rate Equals Yield To Maturity.

From www.youtube.com

Coupon Rate and Yield to Maturity How to Calculate Coupon Rate YouTube Coupon Rate Equals Yield To Maturity the yield to maturity (ytm) is an estimated rate of return. a bond's yield to maturity is the internal rate of return required for the present value of all future cash flows, including. coupon rate refers to the annual interest payment made by the bond issuer relative to its face value, while ytm. If you plan on. Coupon Rate Equals Yield To Maturity.